Table of Contents

Toggle- Unlocking Financial Control with Apps 📲

- Customizing Accounting: App Features to Seek 🔍

- Streamlining Invoices and Payments On-the-go 💸

- Managing Expenses Smartly with Mobile Solutions 🧾

- Deciphering Data: Analytics and Reporting Tools 📊

- Ensuring Data Security and Privacy Protections 🔒

Unlocking Financial Control with Apps 📲

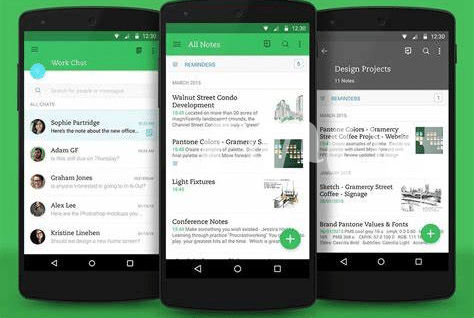

Imagine being able to check your business’s finances as easily as you check the time on your phone. With the right app, it’s that simple. You’ve got the power to monitor money flow, reconcile transactions, and understand your financial standing – all from the palm of your hand. Whether you’re sipping coffee at a cafe or in between meetings, financial insight is just a few taps away. By leveraging these tools, businesses big and small can turn tedious money management into a streamlined, almost effortless task. 🌟

| Benefits | Impact on Business |

|---|---|

| Real-time financial oversight | Make informed decisions on the fly |

| Easy transaction tracking | Stay on top of spending and earnings |

| Quick access to financial data | Saves time for strategic planning |

Consider the efficiency that comes with this digital shift; you’re not just working smart, but you’re working secure. After all, your peace of mind is priceless. 🔐💼

Customizing Accounting: App Features to Seek 🔍

When looking for the best accounting app for your business, there are a few key features to keep an eye out for. The ability to customize according to your business needs is crucial. Look for an app that lets you tailor categories, tags, and even the dashboard to your company’s specific financial operations. Ease of use is also a top priority; you’ll want an interface that’s straightforward, avoiding unnecessary complexity that can eat up your time. An ideal app will have intuitive navigation and a clear design, making your financial management as seamless as possible.

While dealing with finances, staying on top of paperwork is vital. Efficient apps offer features that allow you to convert hard copy documents into digital files easily. For instance, a great addition to your financial toolkit could be a free PDF scanner app for Android, enabling you to digitize receipts and invoices quickly. This complements your accounting app’s functions, empowering you to manage your financial records without being tied to your desk, and keeps all your important documents just a tap away.

Streamlining Invoices and Payments On-the-go 💸

Imagine you’re at a cozy coffee shop, finalizing a deal with a smile and a handshake. 🤝 Yet, the work isn’t over until that invoice is sent and the payment is on its way. That’s where your trusty Android accounting app jumps in, making it a breeze to create and dispatch invoices before your coffee goes cold. No more racing back to the office or wrestling with clunky software. With a few taps on your phone, your client gets their invoice, and you’re one step closer to celebrating a job well done.

But what about getting paid? It’s a joy when payments flow as smoothly as your morning espresso. 🔄 Quick payment features in these accounting apps mean your clients can pay directly through the invoice, with their payments recorded instantly in your app. No more guessing games or bank run-around; just real-time updates that keep your finances as neat as your freshly organized desk. With these tools, every coffee shop, airport lounge, or sofa can become a command center for your business cash flow.

Managing Expenses Smartly with Mobile Solutions 🧾

Keeping a close eye on where your hard-earned money goes can make or break your business. With the power of modern mobile solutions, you no longer need to drown in piles of receipts or struggle with pricey software to understand your spending. Through user-friendly apps, capturing expenses becomes as simple as snapping a photo, and the best part? Many apps integrate smoothly with other finance tools. Imagine having all your costs, no matter how small, lined up neatly, categorized, and ready for review. For receipts that tend to get lost in the shuffle, a handy free PDF scanner app for Android 📄 can digitally store them, ensuring you’re prepped come tax time or budget review. By leveraging these mobile solutions, you’re not just tracking expenses; you’re paving the way for informed financial decisions.💡🔍

Deciphering Data: Analytics and Reporting Tools 📊

Picturing a treasure map, the X marks the spot where our business riches lay hidden. Just like that map, the right accounting app gives us a clear visual of our company’s treasure chest. With easy-to-understand graphs and charts, we can spot where we are sailing smoothly and adjust our course when waters are rough. Imagine seeing your sales trends with just a glance at your phone – that’s the power of mobile analytics at your fingertips.

| Tool | Function |

|---|---|

| Expense Trackers 🧾 | Keep tabs on spending |

| Revenue Charts 💹 | Visualize income patterns |

| Cash Flow Analysis 🌊 | Monitor cash movements |

Moreover, these apps aren’t just about looking back; they forecast future trends too. Wielding these projections, small business owners can make informed decisions about tomorrow, next month, or the next fiscal year. It’s like having your financial future in your pocket, ready to consult whenever the need arises. By harnessing the clarity that these tools provide, maintaining a robust bottom line becomes more of an exact science and less of a guessing game.

Ensuring Data Security and Privacy Protections 🔒

When it comes to handling your business’s books through an app, ensuring the safety of your financial details is just as crucial as balancing the numbers themselves. Think of your financial data as a vault full of precious info that should be guarded fiercely. Opt for accounting apps that come fortified with strong encryption and user authentication measures 🛡️, safeguarding your transactions and confidential data from prying eyes. Regular updates and backups also keep your information not just safe, but also sound and recoverable in case you face a digital downpour. The modern world’s hooded bandits are hackers and data breaches; therefore, vetting your chosen app for its commitment to data protection is a silent crusade every business must undertake. Moreover, don’t overlook the fine print on privacy policies to ensure that your data isn’t the guest star in unwanted scenarios. With careful selection, the right app becomes your ally, armored to protect and serve your business’s financial saga. 🛠️💼