Table of Contents

Toggle- Smarter Budgeting with Ai Insights 📊

- Automated Expense Tracking Simplifies Life 🤖

- Personalized Money Management Tips 💡

- Secure Transactions with Intelligent Fraud Detection 🔒

- Future Predictions for Smarter Savings 🚀

- Revolutionizing Financial Habits with Ai Learning 🌐

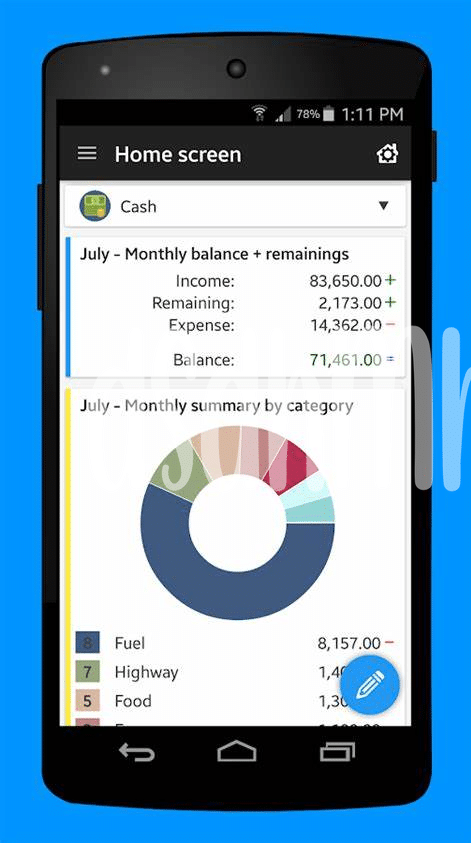

Smarter Budgeting with Ai Insights 📊

Imagine having a clever friend who helps you see your spending habits clearly and suggests ways to save money without making life dull. That’s kind of what AI does in expense apps; it looks at where your cash goes each day and finds smart patterns. Maybe you’re grabbing coffee a bit too often or your gym membership isn’t worth the price because, hey, who knew you preferred running at the park for free? With this nifty AI working on your side, it’s like having glasses that turn your blurry money moves into a crystal-clear picture.

| Before AI Insights | After AI Insights |

|---|---|

| Unclear financial goals 🧭 | Clear saving targets 🎯 |

| Guesswork in spending 🤷♂️ | Informed spending decisions 🤓 |

| Random saving attempts 🐷 | Strategic saving plans 📘 |

And as life keeps ticking, your habits might change. That’s okay, because AI is all about evolving. It learns as you go, always updating its advice to help you stay on the savvy side of spending. No judgment, just smart suggestions born from understanding your own unique path through the maze of money matters.

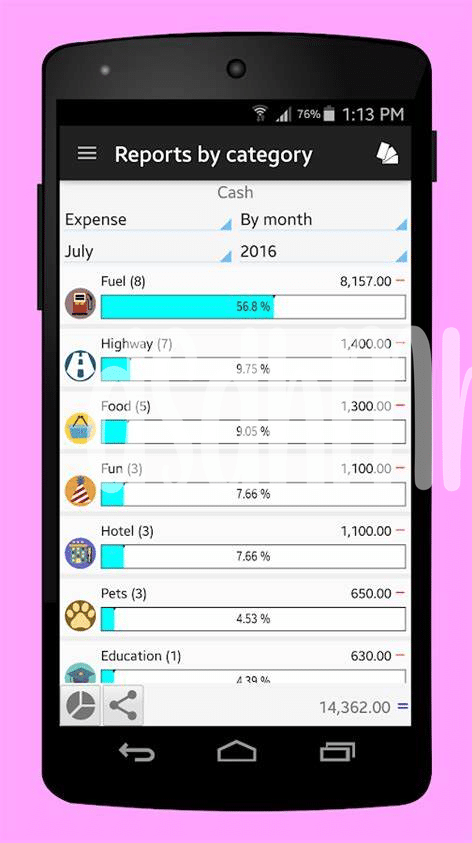

Automated Expense Tracking Simplifies Life 🤖

Imagine having a little helper in your pocket that keeps track of every coffee, every bill, and every little expense without you lifting a finger. That’s what the new wave of Android apps, powered by artificial intelligence, brings to the table. They tirelessly watch over your transactions, categorizing them into neat lists so you can see where your money’s going without the headache of manual entries. This digital wingman even snaps receipts and logs them before you’ve stashed your change away. With this smart tech, you can focus on the joy of living, assured that your penny-pinching buddy has your back. Keep your finances in check and your phone clutter-free by complementing such apps with the best cleaner app for android, ensuring smooth sailing for both your budget and your device.

Personalized Money Management Tips 💡

Imagine getting financial advice that’s just for you, like having a wise friend who understands your spending habits and whispers savvy suggestions right into your ear. That’s what AI in your expense app does—analyzing how you spend your hard-earned cash, it finds patterns and nudges you with tips tailored to you. 🧐 Whether it’s cutting back on those fancy lattes or adjusting your grocery budget, it feels like magic, but it’s really just smart technology. With every swipe and tap, the app learns more, guiding you towards money moves that keep your wallet happy. And before you know it, saving up for that dream vacation or new gadget isn’t just a hope; it’s a plan in action, all thanks to a techy little nudge. 📈🌟

Secure Transactions with Intelligent Fraud Detection 🔒

Imagine a world where your phone is more than just a device for calls or games; it’s your financial safeguard, always on the lookout for anything fishy with your funds. With the brains of AI, your daily expense apps are stepping up their game. They’re like vigilant guardians, always awake, constantly scanning through your transactions. Just as a keen-eyed detective spots clues invisible to others, these apps pick up on any odd patterns or questionable activity that might suggest someone else is trying to sneak into your wallet.

Just as keeping your phone clutter-free is important (like using the best cleaner app for android to keep it running smoothly), keeping your finances clean from fraud is even more so. The AI within these apps learns what’s normal for you, so when something out of the ordinary happens, it’s like an alarm bell that immediately rings, and you’re notified. It’s not just about catching the bad guys though; it’s about peace of mind, knowing that your digital sidekick is always on the alert, allowing you to confidently go about your day. 🌐🔒💡

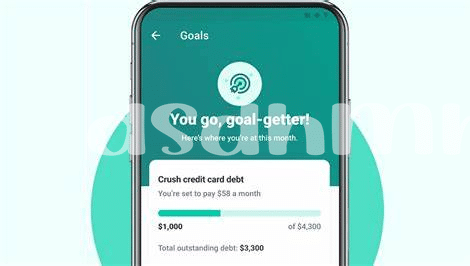

Future Predictions for Smarter Savings 🚀

Imagine a future where your phone becomes your financial advisor, helping you to save smarter just by studying your spending habits. With artificial intelligence weaving its magic, we are stepping into an era where our expense apps not only track but also predict how we could save better. This means fewer surprises and more control over where our hard-earned money goes, nudging us towards our financial goals with ease. 🚀

| Feature | Benefits |

|---|---|

| AI-Powered Forecasting | Anticipates future expenses based on past patterns. |

| Proactive Saving Suggestions | Offers tailored tips to boost your savings. |

| Intuitive Financial Goals Setting | Helps set achievable goals adapting to your financial changes. |

The ripple effect of such innovation is vast, with possibilities extending far beyond basic budgeting. Soon, our phones will not just react to our spending but actively shape it, encouraging us to invest in our future. Intelligent tech will highlight opportunities to grow our savings, transforming financial planning from a chore into a thrilling journey towards prosperity. 💡🌐

Revolutionizing Financial Habits with Ai Learning 🌐

Imagine waking up each day to an app that not only knows your spending habits better than you do but also teaches you how to improve them. That’s the magic AI brings to the table. Using the power of machine learning, these apps can study your transactions over time and nudge you towards better financial decisions. 🌟 Whether it’s cutting down on those extra coffee runs or saving a little extra each month, AI adapts to your lifestyle, making personalized recommendations that fit just right.

With each purchase, swipe, or tap, AI learns a little more about your financial preferences and aversions. 📈 It’s like having a financial coach in your pocket, one that’s constantly evolving with you. As AI gets smarter, your financial understanding deepens, enabling you to navigate the complex world of personal finance with confidence and ease. This continuous learning leads to the development of habits that not only serve your current needs but also lay a strong foundation for your financial future.