Table of Contents

Toggle- The Magic of Sync: Share Your Wallet 💑

- Setting Goals Together: Financial Unity 🎯

- Privacy Matters: Safe Sharing Options 🔒

- Real-time Updates: Keeping Both in Loop 🔄

- Easy Peasy: User-friendly Budgeting Apps 📱

- Splitting Costs: Fairness in Finances 💸

The Magic of Sync: Share Your Wallet 💑

Imagine you and your partner, each holding a piece of a financial puzzle, finally able to fit those pieces together perfectly. That’s what happens when budget apps let you sync your expenses and income across both of your devices. 🔄 No more guessing if a dinner date was paid for or if a bill was settled. You both see every transaction as it happens, weaving together your financial tapestry with ease and understanding. At a glance, knows what’s spent, and what’s saved, making money management a truly joint venture. It’s like having a shared wallet, only smarter and definitely more convenient!

| Feature | Benefit |

|---|---|

| Sync Across Devices | Financial transparency and unity |

| Shared Financial Overview | Harmony in money management |

Setting Goals Together: Financial Unity 🎯

When it comes to managing money as a duo, syncing up on budget apps is like choreographing a dance routine – it’s all about moving together toward a common goal. Imagine planning for a sunny vacation or saving for a new home; it’s more fun when you’re in it together. With the right app, every cent saved feels like a step forward in your shared journey. Beyond individual purchases, this harmonious approach can pave the way to financial freedom and a cushion of security for life’s unexpected twists and turns. 🎯 Moreover, while you’re harmonizing your spending habits and savings goals, it’s crucial to maintain a balance with personal pleasures too. Just like you’d enjoy a tune from the best offline music player for android on your own, it’s important to set aside funds for solo indulgences, ensuring that you both stay happy and motivated as you grow your common pot of gold. 🔄💸

Privacy Matters: Safe Sharing Options 🔒

When it comes to managing money with your sweetheart, you want to be open without giving up your personal space. That’s where budget apps with safe sharing come into play. They let both of you access your shared finances without stepping on each other’s toes. It’s like having a secret handshake, but for your bank accounts. You can peek at your spending, adjust budgets, or cheer on reaching a savings goal – all without worrying about sensitive info being compromised.

And let’s face it, peace of mind is priceless in a relationship. These apps use things like encryption – think of it as a love letter that only you and your partner can read. Plus, they often come with customizable permissions. This means you can decide how much your partner can see or do within the app. It’s all about keeping your financial heart-to-hearts secure, while still holding hands on the journey to your money goals. 🛡️💕💳

Real-time Updates: Keeping Both in Loop 🔄

Imagine this: You’re out shopping and you find a great deal on a new couch that you both have been wanting. You’re unsure if it fits into this month’s budget. Thanks to a budget app with real-time updates, a quick check on your phone reassures you that the purchase is doable. There’s no need to call or text your partner because they’ve instantly received the same update, maintaining financial transparency between you two. This level of synchronization doesn’t just prevent overspending, but also builds trust, ensuring you both stay on the same page with your shared financial journey.

Of course, life isn’t just about tracking expenses and budgets. Sometimes, you want to relax with your favorite tunes. Interestingly, these principles of synchronization and seamless experience also apply when you’re looking for the best offline music player for android, ensuring you have the soundtrack to your life, anytime, anywhere. Just as with your finances, having access to your personal pleasures in sync with your lifestyle makes every day just that much smoother. 🎶🔄💗

Easy Peasy: User-friendly Budgeting Apps 📱

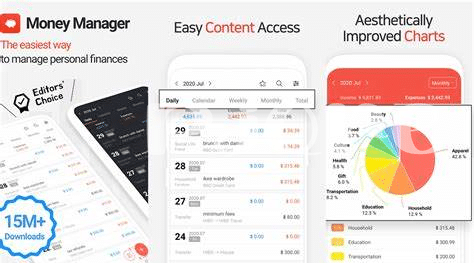

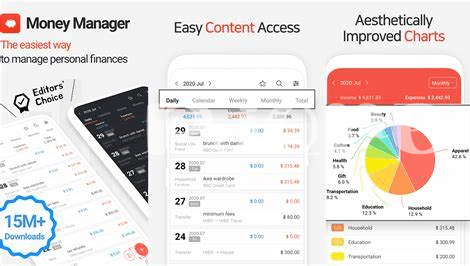

Keeping track of money can sometimes feel like learning a new language, but it doesn’t have to be that way. There’s a whole host of budgeting apps designed with simplicity in mind, which are perfect for pairs wanting to manage their pennies without the headache. 📱 These apps are as easy to use as your favorite social media platform, making the daunting task of finance management actually kind of fun. They offer clear visuals, straightforward navigation, and intuitive controls, practically turning budgeting into a breeze.

Whether you’re saving up for a big trip or just trying to avoid those end-of-the-month surprises, a user-friendly budget app is like having a financial fairy godparent. They take the guesswork out, leaving you and your partner to focus on what’s important. 🎉 You can create budgets, track expenses, and see your savings grow with a few simple taps—and because time is precious, most of these apps can do all this without you needing to manually enter every coffee or cinema ticket. Let the tech take on the tedious tasks! 🛠️

| Feature | Description |

|---|---|

| Intuitive Design | Easy navigation and simple layouts that make using the app a breeze. |

| Visuals | Graphic representations of your finances that help you understand your budget at a glance. |

| Auto-Tracking | Automatic tracking of expenses and incomes to save you the hassle of manual entry. |

| Goals Setup | Ability to set and track financial goals together, ensuring you’re both aiming for the same targets. |

| Notifications | Alerts and reminders to keep you and your partner on top of your finances without constant checking. |

Splitting Costs: Fairness in Finances 💸

When it comes to managing finances as a couple, it’s important to ensure that everyone is contributing fairly to shared expenses. There are budget apps designed with couples in mind that simplify this process. These apps often feature tools for tracking who paid for what and how much each person owes the other. By inputting expenses as they come, both parties can see their contributions in real-time and adjust as necessary to maintain balance and avoid any financial friction.

Common expenses like groceries, rent, or date nights can be entered effortlessly, and the app does the math to split the cost equally or based on a percentage agreed upon by both partners. 🧮✨ Some apps even allow you to categorize spending, which can help when reviewing monthly expenses to ensure both parties feel comfortable with where their money is going. This transparent approach to handling shared expenses not only fosters financial fairness but also encourages open communication about money – a vital component of a healthy relationship. 💕💰